Since the 1990s, the Federal Reserve and Washington--under their respective contemporary leadership--have been veritable tumors on the U.S.

corpus economicus. The chemical marriage between our nation's central bank and central government has been--undoubtedly--the primary cause of our precipitous and painful decade-and-a-half economic decline. Tragically, the majority of Americans don't understand our economy's chronic disease.

The Undiagnosed Disease

In the 1990s, the Federal Reserve and the federal government

--of which Republicans and Democrats shared control--made concurrent terribly-ill-advised policy changes that precipitated the disastrous bubble-bust paradigm that's been disintegrating our economy over the last 15 years.

That decade, the Fed, led by Alan Greenspan,

began the modern Fed tradition of pumping liquidity for long periods of time in the wake of recessions. At the same time, the federal government, whose Legislative Branch

was controlled by Republicans and whose Executive Branch

was controlled by Democrats, passed the

Gramm-Leach-Bliley Act, which repealed

Glass-Steagall, a law created in the wake of the Great Depression that prohibited deposit banks from "investing" (read: playing with) depositors' money. (Indeed, there are many similarities between the modern Fed and federal government and those of the years preceding--and during--the Depression.) Armed with cheap capital pumped by the Fed and a

carte blanche to throw around other peoples'

government-insured money, investors went wild, dumping buckets of Dollars into over-valued tech companies and preposterous dot-coms, multiplying their foolish, nearly-risk-free bets hundreds of times over through a derivatives market that had been

recently deregulated by said bipartisan-controlled federal government. Not surprisingly, the tech bubble eventually burst, the financial system crashed, and the American economy began to feel the symptoms of its new economic cancer.

During the early 2000s recession, the Fed and federal government

attempted to reinvigorate the economy by inflating another bubble, the housing bubble. Greenspan's Fed

once again kept interest rates dangerously low to promote borrowing, even though inflation was becoming problematic. By summer 2008, the median price of a gallon of gas in this country had risen to--in 2014 dollars--$4.70,

a 400% increase in 10 years! The price only returned to earth when the economy crashed.

Also in the 2000s, the Fed began vigorously enforcing the

Community Reinvestment Act,

a passable 1970s law made draconian in the 1990s through legislation passed by--once again--the

Republican-controlled Congress and signed by the

Democrat-controlled White House. The new incarnation of the CRA forced lending institutions to accommodate sub-prime borrowers, a move that was supposed to stimulate the housing market and create equity for the poor. Instead, the CRA created a proliferation of so-called "toxic" mortgages that found their way into investors' portfolios due to legislation sponsored by

Democrats Barney Frank and Chris Dodd--and passed by the

Republican-controlled Congress and White House--that reduced the mortgage-buying standards of

Government Sponsored Enterprises Fannie Mae and Freddie Mac.

With their standards watered-down, Fannie and Freddie began repackaging toxic mortgages as toxic investment vehicles and selling them to institutional

investors, who gladly snatched them up with their cheap, nearly-risk-free capital pumped by the Fed and backed by the federal government. (Sound familiar?) Once again, institutional investors multiplied their foolhardy bets hundreds of times over through the newly-deregulated derivative market. Eventually, the housing bubble, the largest asset bubble in the history of the United States (so far), led to the greatest economic collapse the U.S. had suffered since the Great Depression, a collapse

whose aftermath is still apparent in the job market 6 years later.

The Overlooked Primary Symptom

The decay of the job market has been--by far--the most painful symptom of our economic cancer. Yet, it's one that's tragically overlooked by the majority of the population, whose employment hasn't been negatively affected and whose comprehension of our jobs crisis is limited by the

consistently-unrealistically-optimistic employment data the government spoon-feeds them via the mainstream media. Indeed, one of the many insidious aspects of

this economic depression is that the overall malaise has been--for the most part--

a function of the suffering of an oft-underestimated and disregarded statistical minority: the long-term unemployed and underemployed, whose earning potential and contribution to consumer spending and investment have been crushed. Recall the following chart I published a while back:

In 2012, America's 28 million unemployed or underemployed workers, who

earned a median of $16,000 from unemployment benefits and/or menial employment, forwent OVER A TRILLION DOLLARS in potential earnings. Nothing has been a bigger drag on the economy than lost earnings, which reduce consumer spending--the largest segment of the economy--in the short-term and, in the long-term, delay "life milestone" contributions to the economy such as home ownership and child rearing. The jobs crisis has been--by far--the most acute symptom of our economic cancer, yet its negative influence on the economy as a whole is often overlooked due to its highly-localized nature.

Of course, the jobs crisis has been painful in ways that far transcend negative influence on GDP growth. (GDP growth, by the way,

might not be the best measurement of economic progress anyway.) Far worse than deflating GDP, the crisis has crushed dreams, turned lives upside-down, and

created a new economically-lost generation. It's been particularly hard on young men, whose unemployment and underemployment rates have been consistently higher than those of women of most any age, yet are biologically hard-wired and socially-conditioned to be breadwinners. Lamentably, that devastating detail is also often overlooked.

(As a side note, I highly recommend Gawker's

extensive collection of stories of young male professionals who have been emasculated by the jobs crisis. The series, entitled "Men Talk About Being Unemployed in Their Prime", serves as a poignant reminder that long-term unemployment and underemployment aren't just data sets; they're critical human conditions.)

The Missed Diagnosis

Tragically, most Americans fail to see past their own political myopia to identify our nation's economic cancer. Republicans and Democrats blame each other, of course, and the majority of Americans are too ignorant of economics to realize that the MSM's question

"which party is to blame?" is a fallacious one. A web search of "blame for Great Recession" yields tens of thousands of results neatly divided by party line. In reality,

both parties contributed to our nation's economic collapse, and no entity contributed more than the Federal Reserve.

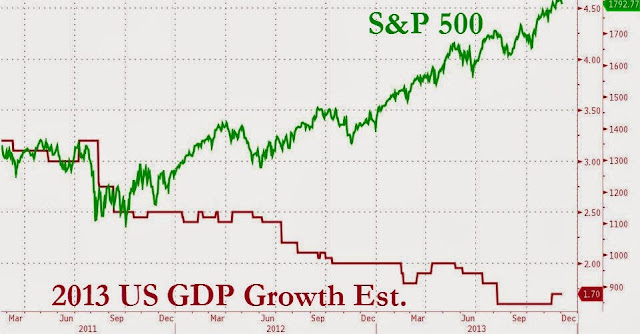

Appallingly, the Fed, now under the stewardship of newly-sworn-in Chairwoman Janet Yellen, is perpetuating the carcinogenic Keynesian monetary policy it adopted under Greenspan and continued under Bernanke. The ultra-wealthy, whose net worth is highly-dependent on the success of the

Fed-juiced stock market, have been making money hand-over-fist during this depression. Average Americans, on the other hand,

have been getting poorer.

New bubbles have been inflated; new malignant tumors have been created. The cancer spreads unbeknownst to most Americans.

Seth Mason, Charleston SC

Update 01/10/15: Because I've ceased publishing ECOMINOES, I've removed a great many articles I believe have become less relevant over time. I've deleted as many links that were broken as I could find...I apologize if I missed any. Also, due to the proliferation of spam, I've closed comments and deleted the ECOMINOES Facebook page and Twitter account.

Update 01/10/15: Because I've ceased publishing ECOMINOES, I've removed a great many articles I believe have become less relevant over time. I've deleted as many links that were broken as I could find...I apologize if I missed any. Also, due to the proliferation of spam, I've closed comments and deleted the ECOMINOES Facebook page and Twitter account.