One need not delve into hardcore economic research to reach the conclusion that the Fed is largely responsible for our country's economic woes. One need only have common sense and possess the ability to read charts.

One need not delve into hardcore economic research to reach the conclusion that the Fed is largely responsible for our country's economic woes. One need only have common sense and possess the ability to read charts.In the mid-1990s, Alan Greenspan's Fed began our central bank's tradition of pumping massive amounts of liquidity. Since that time, stocks and other assets typically held in large quantities by the wealthy have done--for the most part--very well. But, for middle class Americans, who rely on "breadwinner" jobs for their livelihoods, the past 15 or so years have been a period of economic decline, the past 6 years a period of economic free-fall.

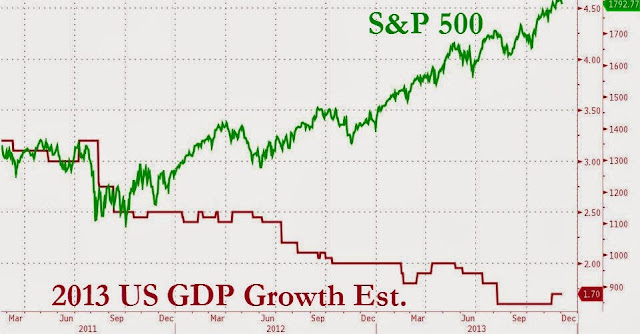

Since peaking at around 67.5% in the late 1990s, the labor force participation rate has declined to 63%, the lowest level since the 1970s, when households rarely sent more than one member into the workforce. The S&P 500, on the other hand, has more than doubled:

Corporate profits and labor force participation also decoupled in the late 1990s. Today, there is little correlation between the two:

What's more, part-time jobs have been replacing full-time jobs since the Fed's tech bubble:

And, since the late 1990s, real wages (adjusted for inflation) have been in decline: