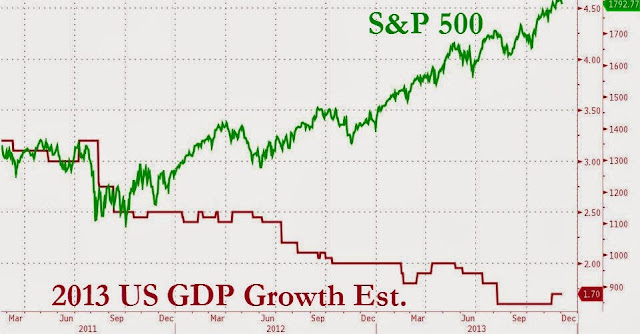

Here's some compelling evidence that the Federal Reserve is looking out for Wall Street investors instead of the Main Street economy: S&P and GDP expectations have been inversely proportional since the Fed announced "Operation Twist" (a bond buying scheme) in October, 2011. As you can see on this chart from Bloomberg, Operation Twist has greatly benefited those whose incomes are strongly tied to the market. But, for the tens of millions of middle class Americans who were unfortunate enough to lose their financial standing after the bursting of the Fed's housing bubble, economic prospects haven't been looking so good.

Here's some compelling evidence that the Federal Reserve is looking out for Wall Street investors instead of the Main Street economy: S&P and GDP expectations have been inversely proportional since the Fed announced "Operation Twist" (a bond buying scheme) in October, 2011. As you can see on this chart from Bloomberg, Operation Twist has greatly benefited those whose incomes are strongly tied to the market. But, for the tens of millions of middle class Americans who were unfortunate enough to lose their financial standing after the bursting of the Fed's housing bubble, economic prospects haven't been looking so good.On the other hand, the Fed's liquidity pumping has juiced the stock market like crazy throughout this economic depression. Every time the Fed has either announced or implemented a new liquidity pumping scheme, the market has risen. Every time one of the Fed's schemes has ended, the market has declined. The economy simply hasn't been strong enough to support the market without the Fed's help. But these actions aren't indefinitely sustainable, and they certainly aren't without long-term consequences.